Proactive Monitoring of Investments

There is a tremendous amount of due diligence done upfront and a lot of work done in the deal structuring that takes place prior to a close. When managing a company, we want to:

• Create not only rear-view visibility, but the ability to look forward with 3-5 year road maps.

• Instill proper cooperate governance, monthly reporting and re-forecasting.

• Strengthen your C- level positions (CEO, CFO, COO) to assure growth in the company.

Value Creation

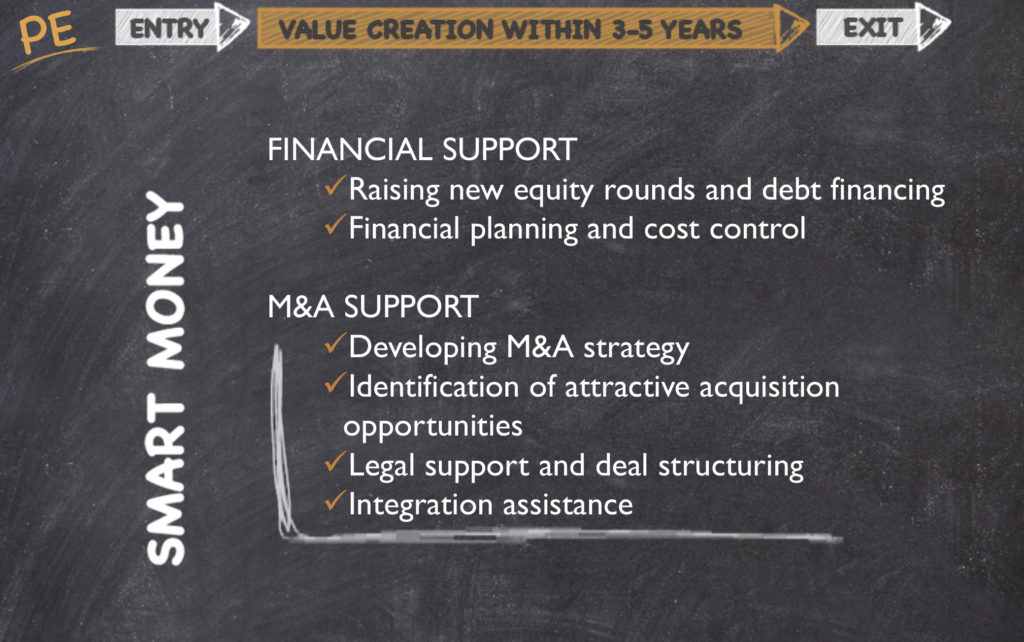

Typically expect a 3-5 year time frame for Private Equity in which the focus is on:

Raising New Equity & Debt Financing – Private Equity is always buying and also selling.

M&A Strategy – There needs to be a well-defined strategy. This could be hiring an investment banker with expertise in an industry, or it might be identifying attractive acquisition opportunities.

Integration Assistance – Working with the management team, we can see what works well and what hasn’t worked well to assure a smooth path towards integrating the acquisition.

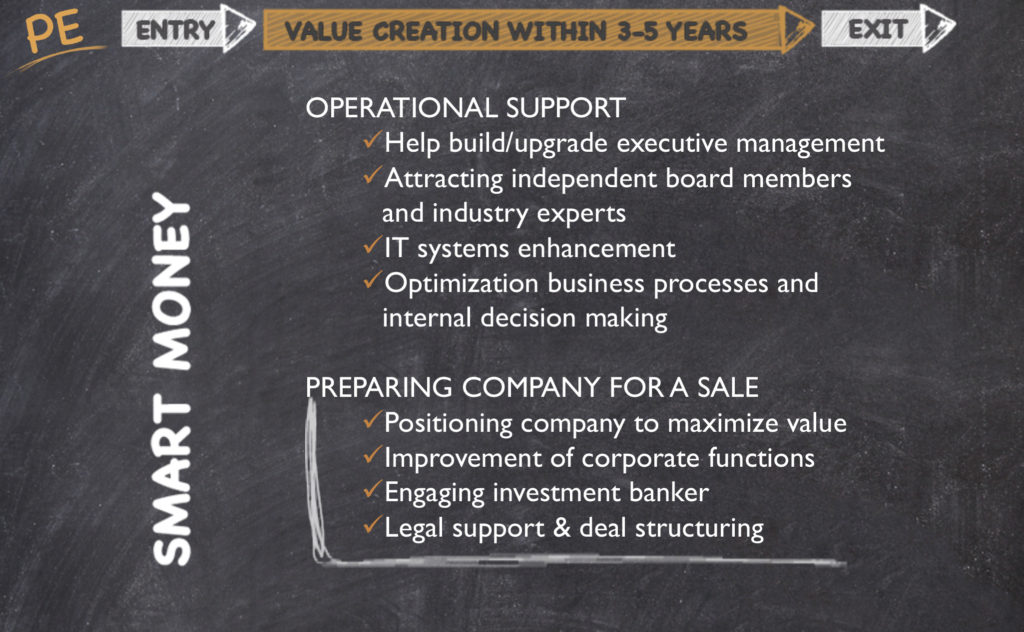

Operational Support

On the operating side, it’s important to:

Build Up The Executive Management Team – Not just growing management but sometimes making changes, such as bringing in a new CEO because the company has hit an inflection and can no longer grow with current CEO.

IT Systems Enhancement is Critical to Operational Support – This could mean looking at sales automation software, and software implementation costs.

Optimization Business Process & Internal Decision Making – Look at the actual workflow that takes place and make decisions based on the positions vs. individuals to prepared for growth.