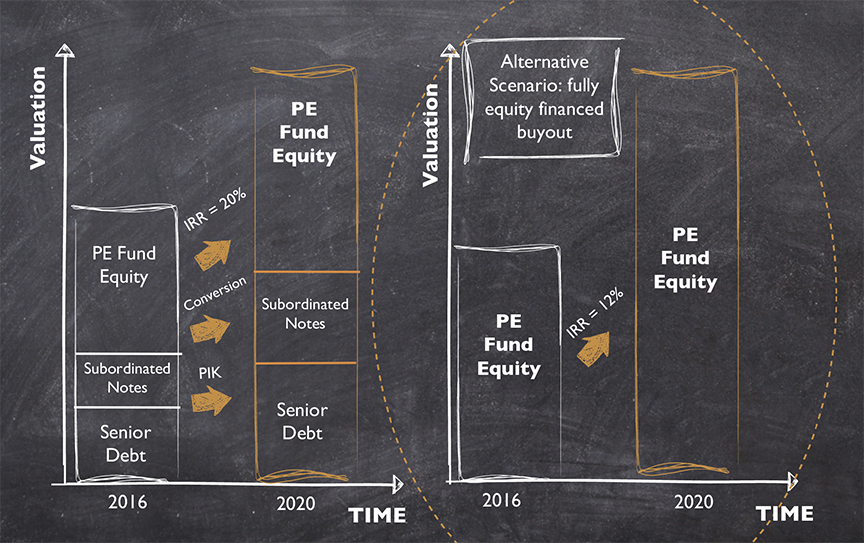

Levered vs Unlevered

In Private Equity deals the goal is to try and get a higher return on the equity invested. Typically, when you look at a conservative deal you will end up with a low double digit internal rate of return (IRR) without leverage. PE firms have found that if you add a reasonable amount on leverage to a purchase you can turn what would have been a 12% IRR into a 20% IRR for investors.

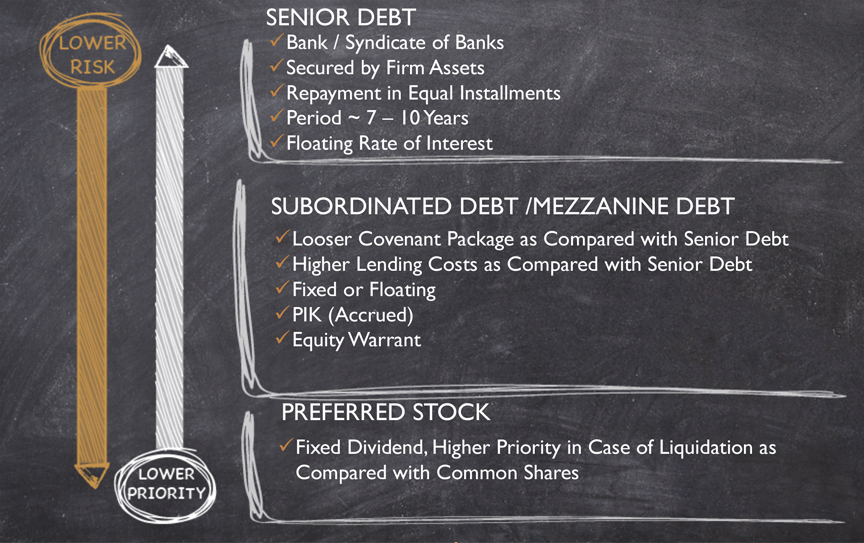

Forms Debt Financing

There are three ways to finance an enterprise:

• Senior Debt: Safest, first money out, least expensive and usually has long term maturity.

• Subordinate Debt/ Mezzanine Debt: Slightly riskier but has potential for higher a higher reward than senior debt.

• Preferred Stock: Similar to taking an equity position, still partake in returns but safer.